Earn Big on Small Moves: Illuminating the Bull Call Spread

- Joshua Enomoto

- Sep 26, 2024

- 4 min read

In my last article about FedEx ($FDX), we discussed deploying a strategy called the bull call spread. A bull call spread belongs to a broader category of options strategies known as vertical spreads.

They’re called vertical spreads because these transactions involve two legs: either a bought call and a sold call, or a bought put and a sold put. The key detail is that both options have the same expiration date, with the only difference being the strike price between the bought and sold options—hence the term "vertical."

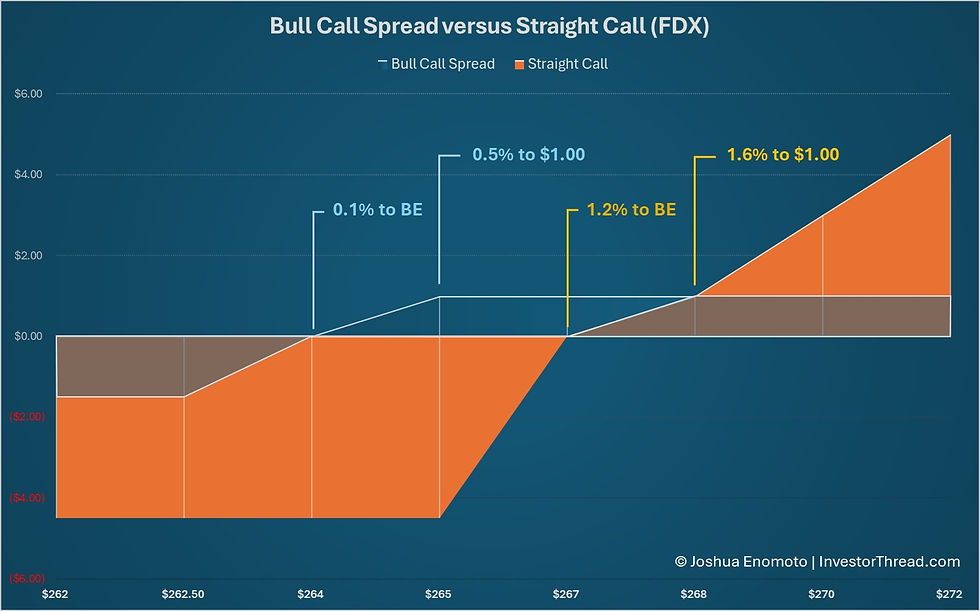

However, investors may initially be turned off by the risk-reward profile of a bull call spread. While it's always good to control your downside risk, the bull call spread also limits your upside. For example, if FDX stock were to continue shooting higher, the better choice would have been a straight call option. With a straight call, there's no cap on your upside potential.

This raises an important question: why bother with a bull call spread? Why not just go for maximum reward potential with a straight call option? While the straight call might seem appealing at first glance, it's crucial to remember that risks are inherent in all trades.

Breaking Down the Call Option

Let’s assume, instead of a vertical spread, we’re simply buying a straight call option. In the example from my previous article, we bought a call option with a strike price of $262.50, paying a premium of $4.50. That amount represents our total debit.

When evaluating this transaction through the lens of intrinsic value at expiration, we must add the premium to the strike price to determine the break-even point. In this case, FDX stock must rise to $267—an increase of 1.22% from Wednesday’s closing price of $263.77—for us to break even.

Now, compare this to the bull call spread, which offered a maximum reward of $1. To achieve this same profitability with a straight call option, FDX would need to rise another dollar above the break-even price, reaching $268. That represents a 1.6% move from Wednesday’s close. In my opinion, that’s a significant movement considering there was less than a week and a half left until expiration.

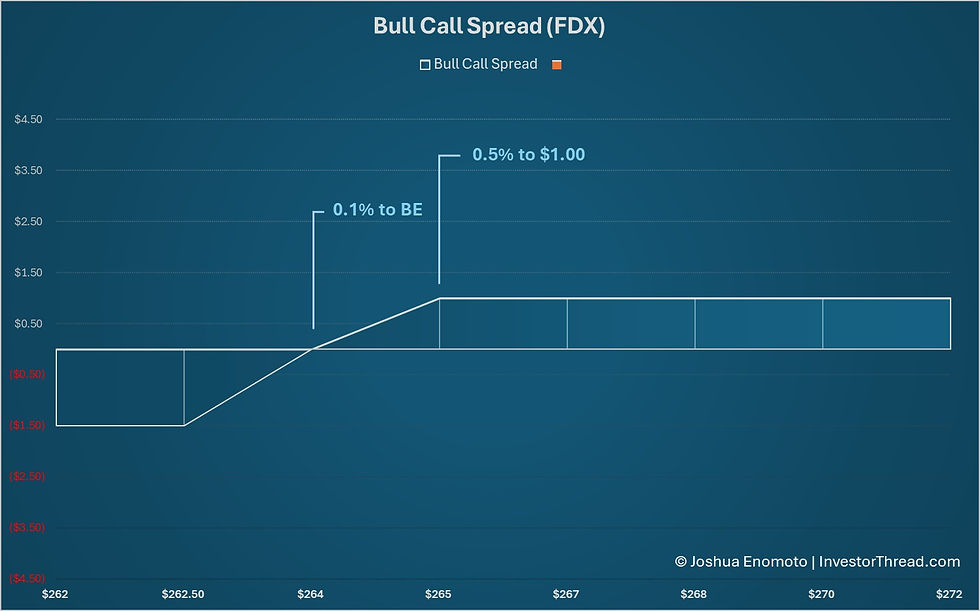

Analyzing the Bull Call Spread

Now, let’s review the bull call spread. First, we bought the same call option with a strike price of $262.50 and paid the same $4.50 premium. However, the key difference here is that this amount is a gross debit, as our transaction isn’t complete yet.

The second leg of the spread involves selling a call option with a strike price of $265. We sell this option at the bid price of $3, generating a gross credit (income).

Now, we subtract the $3 received from the $4.50 paid for the initial call, giving us a net debit of $1.50. Adding this net debit to the $262.50 strike price, our break-even point comes out to $264.

This is significant because $264 is very close to Wednesday’s closing price of $263.77—less than a 0.1% difference. Moreover, our maximum reward comes at $265, meaning FDX only needs to rise by 0.47% to hit our target.

Comparing the Strategies

When buying a straight call option, the reward is simple: anything above the break-even price of $267 is pure profit. For instance, if FDX jumps to $300 per share, the difference between $300 and $267 is money in your pocket.

However, this potential for unlimited profit comes with significant risk. You must pay the $4.50 premium upfront, which is non-refundable. If the trade doesn’t go your way, you’ve just lost $450 for each contract. Buy multiple call options, and this could quickly turn into an expensive mistake.

By contrast, the bull call spread limits your maximum reward to $1 per contract. Even if FDX skyrockets to $1,000 per share, you’ll only receive the maximum reward of $1. But here’s the key advantage: with the bull call spread, you reach the break-even point faster—assuming a positive trajectory for FDX stock.

Additionally, FDX only needs to rise by less than half a percent to achieve the maximum reward, which is a compelling proposition for a large, blue-chip stock that typically doesn’t experience massive swings in a short period.

With a straight call option, FDX needs to move up significantly, relative to the size of the company, just to break even. To match the profitability of the bull call spread, the stock would need to rise nearly 2% before expiration.

Maximizing Opportunity with Controlled Risk

While the limited reward of the bull call spread may seem like a drawback, it’s important to look at the strategy holistically. The capped risk, along with the income received from the sold call option, lowers the threshold to profitability.

Naturally, you wouldn’t use a vertical spread for your highest-conviction trades. But when you have moderate confidence in a stock’s upward movement, a bull call spread makes a lot of sense. It allows you to reduce risk, lower the break-even point, and take advantage of even small price movements—all without the drama of needing a significant rally.

Disclaimer:

Stock trading involves significant risks and is not suitable for every investor. The strategies and ideas discussed in this article are for informational and educational purposes only and should not be construed as financial or investment advice. Always conduct your own research or consult with a licensed financial advisor before making any investment decisions.

Please note that selling options can expose you to unlimited liability if the underlying asset moves against you. It is crucial to exercise your in-the-money bought options to offset the potential liability of your in-the-money sold options, particularly in volatile markets. Make sure you fully understand the risks and mechanics of options trading before engaging in these types of transactions.

Comentarios